FinFloh Credit Decisioning AI

Empowering Faster & Smarter B2B Credit Decisions, Every Time

2024-09-06

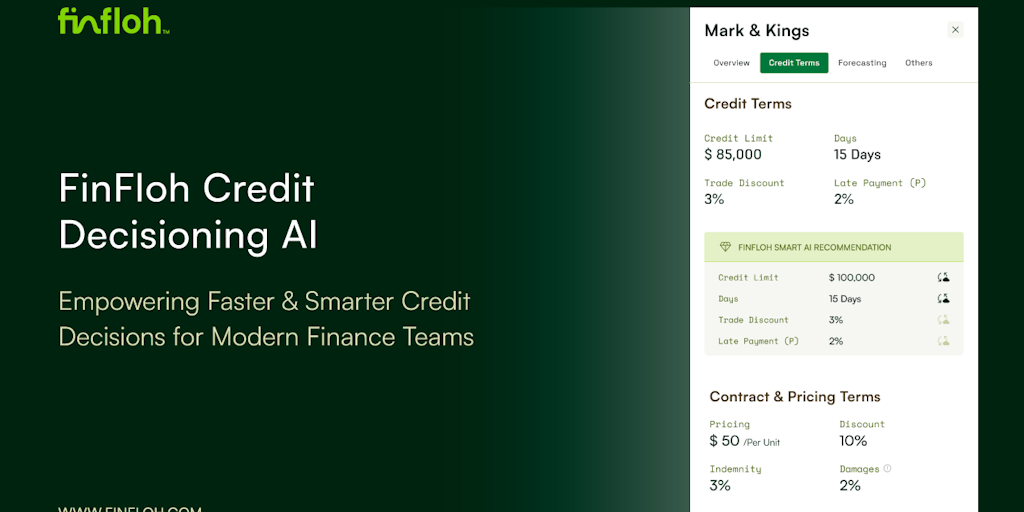

Powered by a ML-driven dynamic credit decisioning algorithm, FinFloh enables businesses with AI-driven accurate credit/contract/pricing decisions across customer lifecycle, esp. during customer onboarding integrated with CRMs like Salesforce.

FinFloh Credit Decisioning AI is a cutting-edge solution designed to streamline B2B credit decisions with precision and speed. Leveraging a machine learning-driven algorithm, it delivers accurate credit, contract, and pricing decisions throughout the customer lifecycle, particularly during onboarding, seamlessly integrating with CRMs like Salesforce. The platform offers automated onboarding with indicative terms, periodic credit reviews to adapt to changing risks, and advanced cash forecasting for better financial planning. Real-time risk alerts and customer segmentation further enhance collections and reduce bad debt. Fully compliant with SOC 2, GDPR, and ISO standards, FinFloh empowers businesses to supercharge their receivables performance while ensuring security and efficiency.

Fintech

Artificial Intelligence

Finance